We are living in fast moving times and as such I thought it would be prudent to provide a quick update on China’s response to Donald Trump’s new tariff model that threatens to up-end trade across the globe as we know it!

China's recent decision to impose a 34% tariff on United States (US) goods is poised to have significant implications for the Pharmaceutical Industry, which relies heavily on a complex global supply chain. This move, a direct response to the US tariffs on Chinese imports, will likely exacerbate existing tensions and create new challenges for pharmaceutical companies operating between these two economic giants.

The pharmaceutical industry depends on a vast network of suppliers for raw materials, active pharmaceutical ingredients (APIs) and manufacturing equipment. Many of these components are sourced from China due to cost advantages and manufacturing capabilities. The new tariffs will increase the cost of importing these essential materials, potentially leading to supply chain disruptions. Companies may face delays and increased expenses as they seek alternative suppliers or negotiate new terms with existing ones.

The additional tariffs will directly impact the cost structure of pharmaceutical companies. Higher import duties on raw materials and APIs will raise production costs, which could be passed on to consumers in the form of higher drug price. This is particularly concerning for generic drugs, which are often produced with thin profit margins. The increased costs could make some drugs less affordable, affecting patient access to essential medications.

The tariffs could also alter the competitive landscape of the pharmaceutical industry. American companies that rely on Chinese imports may find themselves at a disadvantage compared to their international counterparts who are not subject to the same tariffs. This could lead to a shift in market dynamics, with those non-US companies potentially gaining a competitive edge in both the US and global markets.

In response to the tariffs, pharmaceutical companies may need to adjust their strategies and operations. This could involve diversifying their supply chains to reduce reliance on Chinese imports, investing in domestic manufacturing capabilities and seeking new markets to offset the increased costs. Such adjustments, however, will need time and financial investment, which may not be possible for all companies.

The long-term impact of the tariffs will depend on the duration of the trade tensions and the ability of pharmaceutical companies to adapt. If the tariffs remain in place for an extended period, companies may permanently shift their supply chains and production strategies, leading to a more fragmented and less efficient global pharmaceutical market. Additionally, ongoing trade disputes could discourage future investments in cross-border collaborations and innovations, potentially slowing the pace of pharmaceutical advancements.

In conclusion, China's imposition of a 34% tariff on US goods is likely to have profound and multifaceted effects on pharma. While companies may find ways to mitigate some of the immediate impacts, the long-term consequences could reshape the industry's global supply chains, cost structures and competitive dynamics.

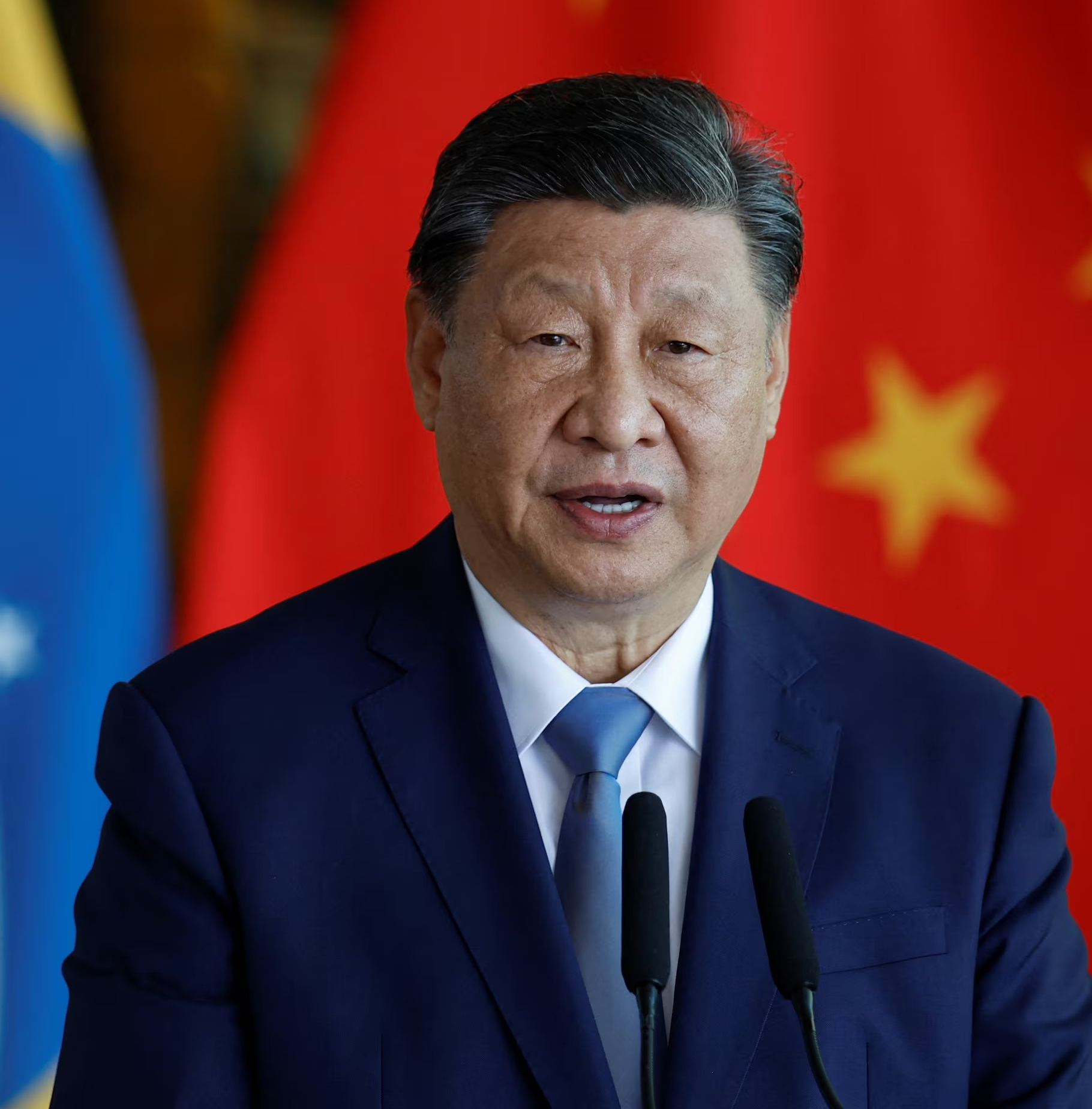

Mr Xi Jinping, President of the People's Republic of China: New 34% Tariff for American Goods.